Why are eStatements required to earn cash back?

As a not-for-profit financial cooperative, Advantis must carefully control operational expenses, so we can return exceptional value to you. This value comes to you as lower- and no-fee services, better savings and loan rates, and – in this case – unlimited cash back. With more members using eStatements, we are able to lower our costs and return more financial value to you!

How do I enroll in eStatements?

That’s easy! After you open your account, log in to Online Banking via our homepage. After you're logged in, click Accounts. Then click eStatements, and register in seconds!

Get more info here.

What if I do not want to enroll in eStatements?

You can use your Cashback Checking account even if you choose to receive paper statements (and it will continue to be a free account). However, you will not earn cash back until you register for eStatements.

How do I earn cash back? Is it really unlimited?

Cashback Checking is special because it is not based on a percentage of spend. And yes, it’s truly unlimited! When you spend $3.00 or more with your Cashback Checking debit card, you earn $0.10 for every debit purchase you make. Cash back is calculated during a monthly cycle.* Debit purchases may be made in store, online, or through Apple Pay, Samsung Pay, or Google Pay. There are NO limits to how much you can earn each month.

How and when do I receive my cash back? What will it look like on my statement?

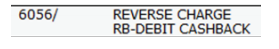

You do not need to redeem your cash back. This is an added benefit of the account (other financial institutions often require customers to "redeem" their cash back). The cash back you earn in any particular calendar month (your account cycle) is automatically posted to your Cashback Checking account on the first day of the following month. You will see a credit on your statement and in online banking. The credit is titled "REVERSE CHARGE RB – DEBIT CASHBACK". It looks like this: