Welcome, Advantis Members!

To the New Rivermark Community Credit Union

Systems Are Combined

You now have access to all 19 branch locations, enhanced Digital Banking convenience, and a variety of additional services. We invite you to explore our updated website and see what's new.

- Branches are open. Walk-ins are welcome, but we recommend scheduling an appointment to minimize wait times.

- We are experiencing an increase in call volumes. We kindly ask for your patience, as our team is committed to assisting you as quickly as possible.

Status Updates: April 23, 2025

You can now call or chat with us from 8 AM to 8 PM on weekdays and 10 AM to 6 PM on Saturdays. We will assist you as quickly as possible.- Bill Pay and Mobile Deposit services have been restored in Digital Banking.

- Some check images in Digital Banking may not display. To request a check copy, please send us a secure message within online banking or the mobile app.

Merger Guide

We invite you to check out our comprehensive digital Merger Guide, which outlines what to expect, along with any changes or actions you may need to take. It includes next steps, key dates, and important information about your account(s).

As a reminder, you should have received a Change in Terms notice on or before January 16 outlining any changes to your product(s) or account(s).

Digital Banking Upgrade

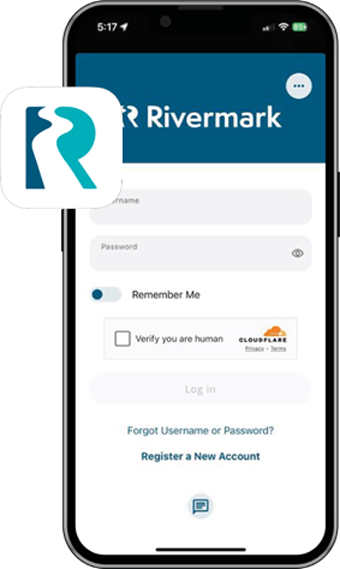

Beginning on March 4, Rivermark will have a new digital banking experience! Rest assured, we’ve been hard at work ensuring all of your transfers, payments, bill payments, payees, and external linked accounts will transfer to our new system.

Beginning on March 4, you’ll log in above using your same username and password as you do today. If you have issues logging in, please use the “Forgot Password” link to reset your password.

A new Rivermark mobile banking app is now available for download. It replaces the former Advantis mobile banking app in the app stores.

- If you do not have automatic app updates turned on, you’ll need to manually update the app on your mobile device once the app is released by the Apple App or Google Play stores.

- If you do not currently have the app on your mobile service, please download the new Rivermark Mobile app in the Apple App or Google Play stores.