- Home

- Rivermark + Advantis

Advantis + Rivermark

Moving forward with a new Rivermark

Rivermark and Advantis officially merged back in October, and we’ve been hard at work behind the scenes to bring together our vision and communities.

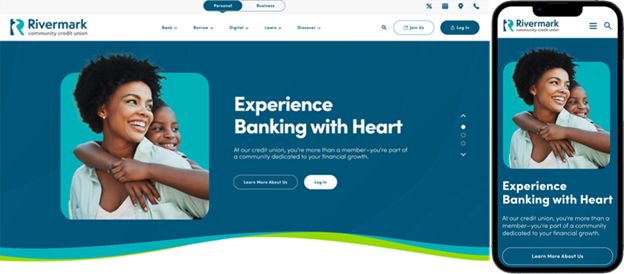

And along with our shared mission of transforming lives and communities together, we're delighted to launch a completely refreshed Rivermark Community Credit Union.

Watch for our new look and updated website in the coming weeks. Your resources and helpful features will be easier to find, both on desktop and mobile.

Social status

And the refreshed Rivermark will have an active online presence as we combine all our social media. So be sure to follow our accounts on Facebook, Instagram, YouTube, and LinkedIn for the most up-to-date info on all things Rivermark.

Members will enjoy new and greater benefits in 2025

This merger gives us the scale and resources to deliver on what our members have been asking for, years ahead of schedule. You’ll begin to enjoy these benefits following the integration of our operations early this year.

|

Twice the branches + extended teller hours. Members will have access to 19 branches in Oregon and SW Washington with extended teller service hours (M-F, 8 a.m. – 8 p.m.; Sat., 10 a.m. – 6 p.m.). That’s twice the locations to get financial coaching and guidance to help you reach your goals. No branches will be closed.

|

|

|

Video banking + extended phone support. Extended contact center hours (M-F, 8 am – 8 pm; Sat., 10 am – 6 pm). Plus a new video banking service. Connect with us by video from the comfort of your home. |

|

|

Enhanced products and services. We expect to be able to return more value to members in the form of better products and services, market-leading rates, low fees, and free services.

|

|

|

Improved digital banking. We’ll have the resources to invest in more technology, providing members with improved digital tools, now and in the future.

|

|

|

Financial coaches at your service, at a branch or via video. Financial wellness is important at both credit unions, and this creates a multiplying effect. With more than 75 FiCEP-certified financial coaches across both organizations, including over 20 bilingual coaches, we’ll meet members wherever you are on your financial journey.

|

|

|

Greater impact for your community. Advantis and Rivermark have established a combined purpose: to transform lives and communities, together. That may sound like a tall order. But we’re up to the task, with financial coaching and wellness programs, philanthropic giving, volunteerism, non-profit partnerships, and much more.

|

|

|

Same knowledgeable, caring employees. We’re not going anywhere. You’ll see the same friendly faces, just in more places.

|

Frequently asked questions

What were the results of the Advantis member vote?

As a member-owned credit union, the final decision to merge was up to our members, and we’re thrilled to have their strong support to move forward. Advantis members overwhelmingly approved our merger with Rivermark Community Credit Union on September 23, 2024, with 88% of ballots cast in favor. Member voting occurred from August 5 to September 23, preceded by state and federal regulatory approval, along with a unanimous vote in favor of the merger by the Advantis Board of Directors.

When did Advantis and Rivermark legally merge?

Advantis and Rivermark legally merged as one entity on October 1, 2024, and our member documents began to include the name “Advantis Credit Union, A Division of Rivermark Community Credit Union.” This reflected Advantis assuming Rivermark’s charter. Our name will fully transition to Rivermark Community Credit Union and members will begin to enjoy the many benefits of the merger in early 2025.

Why did Advantis and Rivermark Community Credit Union pursue this merger?

With this merger, we’ll be able to deliver more benefits to our members, faster – including double the locations, advanced technology offerings, and enhanced products and services years ahead of schedule.

By creating a distinctive credit union that will stand out from the 65 total credit unions and banks in the Portland metro area, we’ll have the scale to serve our members and our community with greater impact.

Lastly, we aim to emerge as the leader in fostering financial wellness for our members and the community in Oregon and SW Washington, including historically marginalized and underserved communities.

Why did Advantis members vote on this merger?

Following the unanimous vote of support of our board, along with Federal and State regulatory approval, the final decision to merge was up to our member-owners. Advantis is assuming Rivermark’s charter, which means Advantis members voted on this merger, as required by regulation. In every credit union merger, one must assume the charter of the other, with it being referred to as the “continuing credit union.” This reference should be considered in the strictest legal sense and does not mean Rivermark is acquiring Advantis; we will combine our assets, resources, and staff as equal partners.

Why did Advantis assume Rivermark’s charter?

Rivermark has been certified as a Community Development Financial Institution (CDFI) by the U.S. Department of the Treasury. CDFIs are mission-driven organizations that focus on serving low-income and underserved communities, and allows for the credit union to secure additional grants to do highly impactful work in the community. The CDFI certification is tied to Rivermark’s charter, which means the merged credit union will have a much greater chance of maintaining this highly sought designation.

Was Advantis acquired by Rivermark?

No. Neither credit union took over the other. This is a true merger of equals, with two credit unions uniting as one and bringing forward the best of both. While the new combined credit union will be named Rivermark, current Advantis President & CEO Jason Werts will retain his position and role in the merged organization. Additionally, Advantis will hold an initial 6-5 board majority of the merged credit union. These mutually agreed upon decisions reinforce the equal manner of our merger.

When are both credit unions legally merged? What will change at that time?

With the recently concluded vote of approval by Advantis members, the credit unions legally merged in early October, becoming one entity. After this date, our member-facing communications and documents began including the name “Advantis Credit Union, A Division of Rivermark Community Credit Union.” This reflects Advantis assuming Rivermark’s charter, as noted above. Most members will see no changes until we integrate our systems in early 2025.

Do members still use the same online banking and debit and credit cards?

Yes. You’ll continue logging into the same Advantis Online & Mobile Banking, and using your current debit and credit cards now and after the merger. In early 2025, members will need to download an updated mobile app that reflects our new Rivermark name. And as cards near their expiration date, we’ll replace them with cards that also reflect our new Rivermark name.

Will there be a change to my account number(s)/member number(s)?

Our highest priority is to achieve as much consistency and continuity as possible in these areas, as we understand convenience is top of mind for you. We’re nearing a determination on what changes may be needed and will communicate this as soon as it’s finalized. We appreciate your patience, and please know that we’re committed to minimizing any potential member impact. If any change occurs, it will not be until early 2025.

When can I start using Rivermark branches?

Rivermark branches will not be available to Advantis members until after the integration of our systems in early 2025. We know you’re excited about double the number of branches, and appreciate your patience. We’ll let you know as soon as the 19-branch network is available to all members. This was one of the merger’s greatest benefits, and you’ll soon enjoy new branches in Vancouver, Happy Valley, Tualatin, the Dalles, and other areas Advantis doesn’t currently have a branch.

Will you close any branches?

There are no plans to close any branch locations as a result of this merger. In fact, this merger will provide the opportunity to expand our branch locations and enhance our digital member experience.

Are both institutions financially safe and strong?

Yes. Both have capital (or a rainy-day fund) exceeding the regulatory standard for “well-capitalized” credit unions, and continually operate within the regulatory definition of “safe and sound” practices. Both have a strong liquidity position and maintain a balanced loan-to-deposit ratio. The strength and soundness of our credit unions only reinforced the board’s and leadership’s interest in merging.

Will I continue to enjoy the same online banking experience?

Yes. Plus, Advantis members will enjoy welcome upgrades following system and operational integration with Rivermark. This means the features you’ve come to know and love, as well as important pieces like your username, scheduled transfers/payments, and bill payees will all remain intact. You can look forward to a number of new features, like instant external account transfers, immediate credit card payments, and improved mortgage account access.

How will my accounts and favorite Advantis product(s) be affected?

Change in terms notices were sent to members on January 16, 2025. Refer to the change in terms for details on changes to products and fees. Rest assured that account and product changes were made only when absolutely necessary or if it provided you with better benefits or enhanced features.

What if I recently ordered checks or plan to soon?

We are working diligently to make this merger as seamless as possible for you, and whether an account change will be needed is still to be determined. If an account change is needed, it wouldn’t happen until early 2025, so please continue to order and/or use Advantis checks as you normally would. If you have unused checks that need to be replaced due to an account change in the future, the credit union will cover the cost. If there are no account changes, the checks you have today will continue to work and will not need to be replaced. We will follow up as we have more information.

Will my existing accounts continue to be insured? What if I have accounts at Rivermark as well?

Yes. Your Advantis accounts opened before legal merger continue to be federally insured by the NCUA. You still have up to $250,000 in protection on your accounts, and a separate $250,000 in protection on IRA accounts for a period of six months after legal merger. This grace period is intended to give you time to make any arrangements you may need if your combined balances at Rivermark and Advantis exceed $250,000. Since the legal merger occurred on October 1, 2024, your funds at accounts opened at Advantis prior to legal merger will continue to be separately insured from any accounts you may have at Rivermark until April 1, 2025.

If the combined balances in all your Rivermark and Advantis accounts exceed $250,000, please contact us so we can discuss options.

Does the grace period apply to all members or only to those with accounts opened prior to the legal merger?

The grace period applies only to accounts opened prior to October 1, 2024.

What about accounts opened on or after legal merger?

Accounts opened after legal merger (October 1, 2024) will be considered as opened with Rivermark. The $250,000 NCUA coverage amount will cover both Advantis and Rivermark accounts together.

After October 1, 2024, if existing members open an account at Advantis ,or someone opens a new membership, they will sign a disclosure acknowledging that NCUA coverage now applies to both Advantis and Rivermark as a single entity.

Does renewing my existing certificate count as opening a new account?

If you renew your certificate for the exact same terms, it does not count as opening a new account. For example, if you roll over your 12-month certificate into a new 12-month certificate, it is not considered a new account and you continue to be protected under the NCUA grace period coverage. However, if your certificate is renewed into a different term or type, then it will be considered a new account and the balance in the certificate will be added to any accounts you may have at Rivermark for share insurance purposes.

If I have existing accounts at both Advantis and Rivermark prior to legal merger, will new deposits to those accounts also be covered during the extension period?

Yes. You can use your credit union accounts as you normally would. Additional deposits, such as payroll, social security, and tax refunds, made to accounts existing before legal merger will continue to be covered during the 6-month grace period. However, if one or more deposits bring your combined balances at Rivermark and Advantis above $250,000, you should promptly evaluate options for increasing share insurance coverage or consider moving some of the funds to other institutions. Six months after legal merger, the separate share insurance coverage on your Advantis balances will stop and your combined balances at Advantis and Rivermark will be insured up to $250,000.

Will my rates or account features change? Will you continue to offer great rates and low fees?

Change in terms notices were sent to members on January 16, 2025. Refer to the change in terms for details on changes to products and fees. The rates on your fixed-rate loans and certificates will remain the same until the end of their existing terms. Rates on other products will continue to adjust based on market conditions, just as they do today. As a merged credit union, we’ll continue to provide market-leading rates, low fees, and more free services.

Will I still get the same level of service? I don’t want my credit union to feel like a big bank.

Yes, absolutely! While the merger will bring a number of exciting changes for members, just as important are the things that won’t change. Like finding the same friendly faces and personal service from your trusted, local not-for-profit financial co-op. In other words, NOT a big bank. Additionally, after systems integration members will enjoy new video banking services along with extended video teller hours.

I care about your employees. Will this merger affect their jobs?

Our employees are vital to serving our members. We will not reduce staffing levels or conduct layoffs as a result of this merger. In fact, the merger is likely to provide greater growth opportunities for employees.

Can we still use other credit union (CO-OP) ATMs?

Yes. You’ll still have access to all the CO-OP ATMs at no charge, as both organizations are part of the CO-OP ATM network.

Do Advantis and Rivermark share similar values?

Yes, we do. In fact, we’d be hard-pressed to find another organization that is more like (each of) us. Both credit unions have deeply held values around providing financial empowerment and advocacy for its members, supporting and fostering diversity, equity, and inclusion, and making a difference in our communities. We also share a deep commitment to better serving historically marginalized and underserved communities. We’re proudly progressive and inclusive – as financial institutions, employers, and community partners.

Who is Rivermark? Do they have a long history of serving the community like Advantis?

Headquartered in Beaverton, and founded in 1951, Rivermark Community Credit Union holds over $1.4 billion in assets and serves 90,000 members. Rivermark’s mission is “Building Financial Empowerment Together” by providing members with the confidence to make good financial choices with consistently superior financial solutions and trusted advice. Visit their website to learn more.

Like Advantis, Rivermark was founded decades ago, formed by a group of co-workers committed to pooling their resources to support each other with affordable loans and stronger savings rates. Our beginnings were with city and county and power company employees, and Rivermark’s were with grocery store employees (Safeway). While our member bases were different, each credit union had – and continues to have – a strong commitment to low-cost financial services for hardworking people, especially those who need them most.

Why did we choose to merge with Rivermark instead of one of the other credit unions?

While all credit unions have a lot in common, a merger between Rivermark and Advantis will maximize the benefits for all of our collective members. Rivermark and Advantis have very similar missions, visions, and values and look forward to building synergy together to better serve our current and future members.

Who will lead the merged organization?

Jason Werts, current President & CEO of Advantis, will be the President & CEO of the combined organization. Seth Schaefer, current President & CEO of Rivermark, will serve as Executive Vice President and Chief Impact Officer. Seth’s role and his division will be dedicated to delivering sustainable impact to our members and the community, with oversight over financial wellness, advocacy and strategy, community impact, communications, and diversity, equity, and inclusion programs and initiatives. This merger has the full support of Jason and Seth, as well as the executive and leadership teams of both organizations.

Has a name been chosen for the combined credit union?

Yes, the name of the combined credit union will be Rivermark Community Credit Union.

Why not a new name?

Both credit unions have strong and respected brands in our local market, and because of this valuable brand equity, it was much wiser to choose a known and respected name versus an entirely new name with no brand awareness. This will give us an advantage in terms of growth potential and the results we can achieve in a local market that’s very crowded with 65 total credit unions and banks in the Portland metro area.

Why did we choose the Rivermark name?

In a recent market study of local consumers, both names had strong brand awareness. However, Rivermark had higher awareness, especially in Washington and Clackamas counties. This gives us a real jump start, with more of our community being familiar with our combined name.

The name resonated with consumers as a “local” feeling brand, with its reference to the rivers characteristic of our area. And very few organizations nationwide have the Rivermark name. In addition, Rivermark currently holds Federal trademarks, providing greater brand protection.

While we are assuming the Rivermark name, Advantis and Rivermark are combining our assets, resources, staff, policies, and programs as equal partners, and in largely equal measure.

Other questions? Just want to get in touch?

- Send a secure message in Advantis Online Banking or via our mobile app.

- Connect with us via chat anytime on our website.

- Call at 503-785-2528, Mon - Fri, 8 am - 6 pm.

- Schedule a branch appointment to speak in person.